Evaluating network tokens: Webinar Q&A

Network tokenization promises better authorization rates, reduced fraud, and enhanced security, but implementing it comes with real questions.

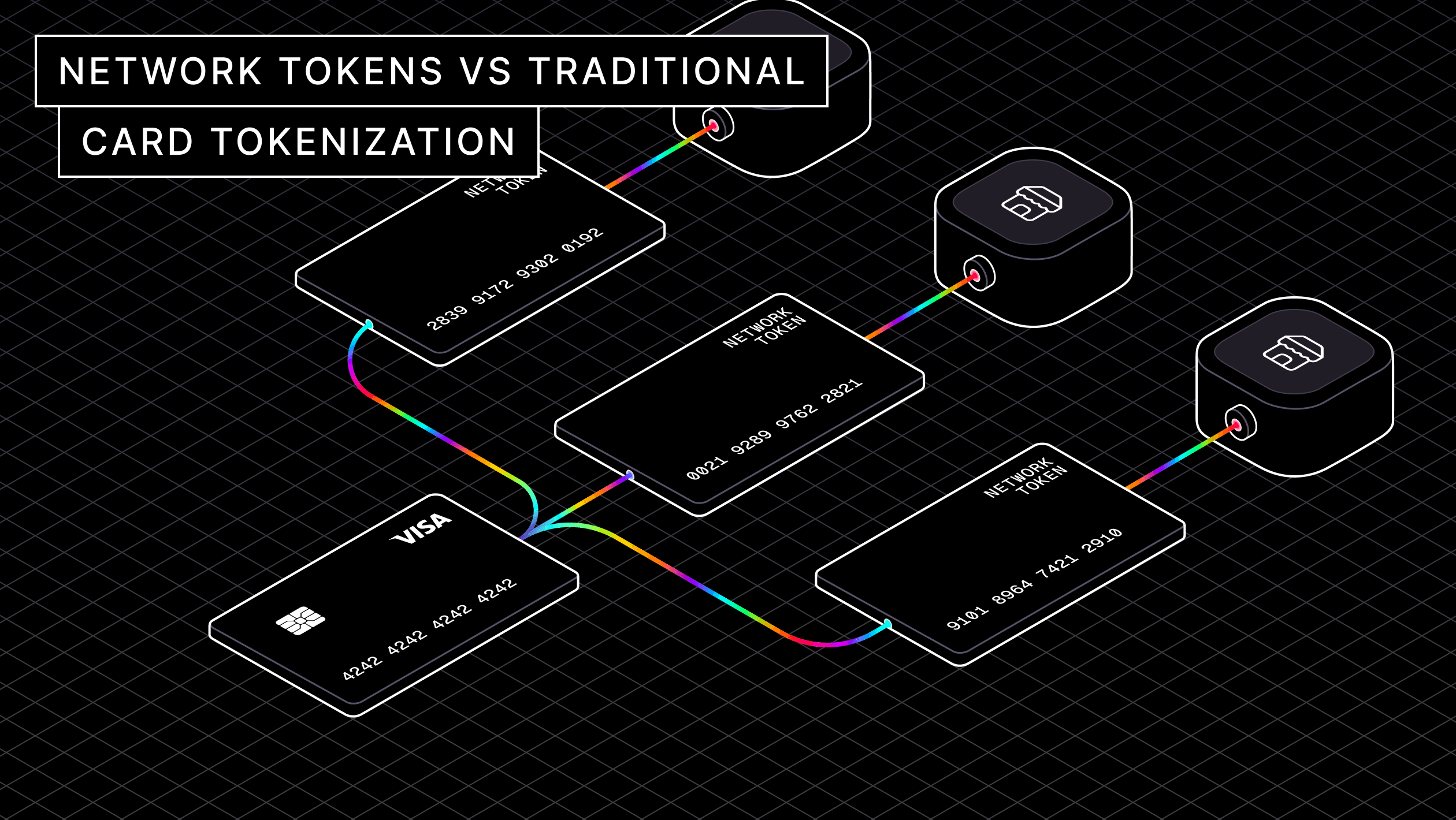

Tokenization has been a flagship strategy for protecting card data while retaining details for future charges. For years, traditional card tokenization has served as a primary strategy, where card numbers are replaced with unique tokens by a third-party payment solution. However, in recent years, network tokens have emerged as a modern alternative, offering a dynamic, flexible approach to payment security.

Today, we’ll explore the key differences between these tokenization methods, detailing their respective strengths and challenges alongside their impact on merchants and customers.

Traditional card tokenization was developed to protect cardholder data by replacing it with tokens, randomly generated strings of numbers and letters. These tokens are tied to a specific merchant and stored securely, ensuring they cannot be used outside the environment—even if intercepted.

Traditional tokenization is straightforward. There are multiple providers—including Stripe and Evervault—and it integrates easily into existing systems, making it cost-effective for small to mid-sized businesses. Merchants also appreciate the ability to control token management entirely within their environment.

Traditional tokens have some drawbacks. They’re siloed, meaning they can’t be used across merchants. Card replacements or expirations also require manual updates, leading to potential transaction declines and lost revenue.

Network tokens, managed by card networks like Visa and Mastercard, are a next-generation solution designed to address the limitations of traditional tokenization. These tokens are dynamic, centrally managed, and work across multiple merchants and channels.

Network tokens replace the primary account number (PAN) with a unique token that is specific to the customer and can be updated automatically. This dynamic nature ensures that the token remains valid even if the original card is replaced or expires, avoiding disruptions.

These tokens are managed by token service providers (TSPs)—entities responsible for generating, storing, and managing the lifecycle of tokens. TSPs can include card networks, issuing banks, or standalone third-party providers. By centralizing token management, TSPs reduce the burden on merchants and ensure token consistency across the payments ecosystem.

Network tokens introduce the concept of token domains, defining the specific contexts in which a token can be used. For example, tokens can be restricted to:

These token domain restriction controls enhance security by ensuring that tokens are only valid in their designated contexts, reducing the risk of misuse.

Network tokens also simplify cardholder verification for customer-initiated transactions (CITs) and merchant-initiated transactions (MITs).

This dual approach balances security for customer-driven transactions with ease of use for merchant-initiated payments, creating a versatile solution for businesses of all sizes.

Apple Pay illustrates the potential of network tokens to revolutionize payment security. Acting as a token requestor, Apple integrates directly with token service providers to generate and manage tokens for its users. In addition to leveraging the EMVCo payment tokenization standard, Apple Pay includes advanced features such as:

These additional security features, combined with the interoperability of network tokens, highlight how they could be extended as a modern payment method.

| Feature | Traditional tokenization | Network tokens |

|---|---|---|

| Automatic updates | Requires manual updates when cards expire or are replaced, leading to potential disruptions | Updates automatically, ensuring uninterrupted transactions and reducing customer churn |

| Fraud prevention | Offers static security but lacks dynamic fraud prevention measures | Utilizes transaction-specific cryptograms for enhanced fraud detection and reduced risk |

| Cross-merchant use | Tokens are restricted to a single merchant’s system | Works across multiple merchants, platforms, and payment channels, ideal for omnichannel use |

| Customer experience | Customers may experience interruptions during card updates | Provides a seamless experience, even when cards are replaced or expire |

| Ease of implementation | Simple and cost-effective to integrate with existing systems | Requires more complex system updates and integration with card networks or TSPs |

| Scalability | Limited to individual merchants, making it less flexible for growing businesses | Scalable across different regions, merchants, and payment platforms |

Despite their advantages, network tokens come with certain challenges. Implementation often requires significant updates to payment systems, and merchants may need to rely on card networks or TSPs for token management. Smaller businesses using network tokens through a payment service provider (PSP) may face vendor lock-in, limiting future flexibility.

As card networks push for broader adoption of network tokens—citing benefits like improved authorization rates and reduced fraud—traditional tokenization may increasingly take a backseat. While traditional tokenization remains a viable option for businesses with simpler needs, network tokens are clearly positioned as the next step in the evolution of secure payments.

Until then, network tokens and traditional card tokenization each serve valuable roles in today’s payment landscape.

Create and use network tokens in minutes with Evervault’s streamlined APIs. Avoid payment gateway lock-in and time-consuming direct integrations with card networks.

Learn More